1. Declaration

Passengers carrying cash with amount exceeding either VND 15.000.000 or USD 5,000 or equivalent must declare to Customs Foreign Currency Report Desk.

2. VAT Refund eligibility

Passengers are eligible for tax refund when they meet the following conditions: They are foreign tourists and do not possess a Vietnamese passport; They are not part of the crew on flights departing from Vietnam to other countries; They make purchases at stores that apply for tax refund within Vietnamese territory; The products/goods are carried by the passengers on the flight.

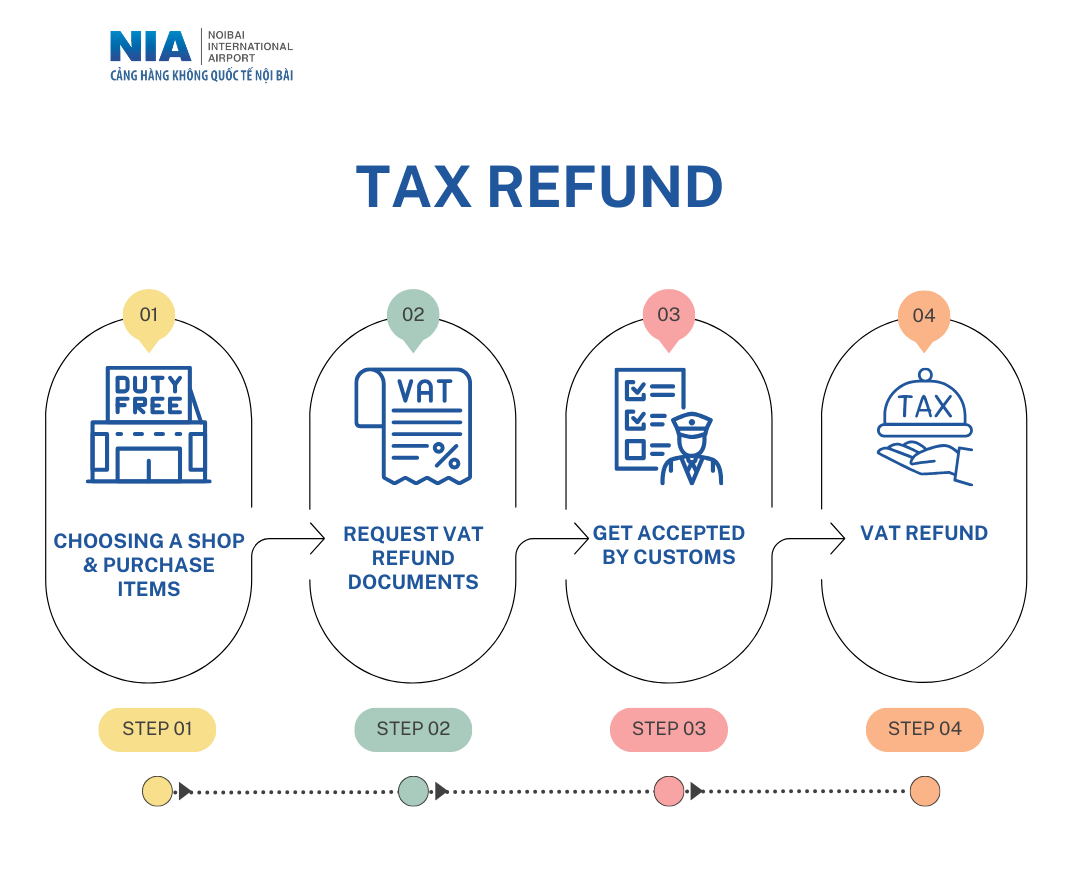

Step 1: Choosing a shop & purchase items

If passengers wish to receive a VAT refund, please shop at stores that apply for VAT refund. The total value of goods stated on the invoice, along with the tax refund declaration form from one store in one day (including the combined total of multiple invoices from the same store on the same day), must be a minimum of 2,000,000 VND or more.

Step 2: Request VAT refund documents

After completing the shopping, passengers are required to present their passport and request the staff at the store to provide the tax refund declaration form and the purchase invoice. The invoice with the tax refund declaration form is issued within 30 days from the departure date.

Please keep all the documents, including the complete invoice, carefully for the tax refund process at the airport. Any missing documents will result in the denial of the tax refund.

Step 3: Get accepted by customs

Before the check-in process, please present your passport, original purchase invoice, tax refund declaration form, and the purchased items at Customs for inspection and stamping of the tax refund confirmation.

Step 4: VAT refund

At the Tax Refund Counter, present your passport, boarding pass, invoice, and stamped tax refund declaration form to proceed with the tax refund, with a maximum service fee of 15% of the refundable amount.

The refund will be made in Vietnamese Dong. If you wish to receive the refund in a different currency, the exchange rate will be based on the current rate of the authorized bank for VAT refund.

For more information, passengers can visit the website Tổng cục Hải quan.